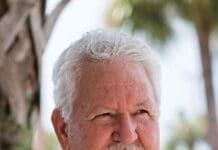

By Maurice Stouse, Financial Advisor and Branch Manager

Depending upon which type of bond you are looking at, it is painfully obvious that bond yields are at or near their lowest levels since 1969. Institutional investors around the globe continue to buy bonds which in turn drives the prices for the bonds up and the yields down. What options or alternatives do individual investors have? Individual investors use bonds or interest-bearing securities mainly for two reasons: The first is portfolio diversification (asset allocation between stocks, bonds and cash) in order to reduce risk and potentially lower volatility. The second would be for an income stream. Many of those folks are in retirement and need income to supplement social security, pensions and savings in order to maintain their lifestyles.

Depending upon which type of bond you are looking at, it is painfully obvious that bond yields are at or near their lowest levels since 1969. Institutional investors around the globe continue to buy bonds which in turn drives the prices for the bonds up and the yields down. What options or alternatives do individual investors have? Individual investors use bonds or interest-bearing securities mainly for two reasons: The first is portfolio diversification (asset allocation between stocks, bonds and cash) in order to reduce risk and potentially lower volatility. The second would be for an income stream. Many of those folks are in retirement and need income to supplement social security, pensions and savings in order to maintain their lifestyles.

Money market mutual funds, in the most conservative asset class of cash, are now seeing yields above 2% for the first time in over a decade. Bonds and bond mutual funds (or the fixed income class) have higher yields but also can fluctuate in price (increasing when yields decline and decreasing when yields go up). There are also fixed rate annuities as well. And for those investors with a higher risk tolerance (moderately aggressive) there are dividend paying stocks that they can consider. First take note that the yield for the S&P 500, as a group, is currently approximately 2%. Utility stocks (which as a group have an average yield of about 3%) are one area investors can look to with some individual utility stocks of those yielding 4-5%. The appeal (again for the moderately aggressive investor) is not only the dividend yield but that, as a sector, utilities are considered defensive when it comes to stocks. And they might experience share value growth as well. “Defensive” stocks are those companies which are usually not as volatile to negative economic influences. Buying individual stocks carries more risk so an individual investor should do their research – as well as consider spreading out their investment.

Other dividend paying alternatives can be found in consumer staple stocks, which is also considered a defensive sector. Consumer staple stocks are usually the stocks of those companies that do not experience as much volatility when the market moves drastically (as it can). The yield for the unmanaged index of consumer staples stocks approximates 2.7% but an investor would need to look over these stocks if they are in search of higher yields than the average. Lastly, health care stocks are a defensive sector as well. Many investors consider health care stocks to have resiliency in demand and that unmanaged index has a yield that approximates 1.7% so investors, if seeking higher yields, would need to do further research. Energy stocks, while not defensive (the energy sector is cyclical) have an average yield of over 3% and again there are individual companies that pay higher dividends than the average.

Time frame and risk tolerance play an important role in managing your portfolio. If you are seeking higher yielding alternatives, be sure to work with your advisor or do your own research before making decisions.

Maurice Stouse is a Financial Advisor and the branch manager of the First Florida Wealth Group and Raymond James and he resides in Grayton Beach. He has been in financial services for over 32 years. His main office is located at First Florida Bank, 2000 98 Palms Blvd, Destin, FL 32451. Branch offices in Niceville, Mary Esther, Miramar Beach, Freeport and Panama City. Phone 850.654.8124. Raymond James advisors do not offer tax advice. Please see your tax professionals. Email: Maurice.stouse@raymondjames.com.

Securities offered through Raymond James Financial Services, Inc. Member FINRA/SIPC, and are not insured by bank insurance, the FDIC or any other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject to risks, including the possible loss of principal. Investment Advisory Services are offered through Raymond James Financial Services Advisors, Inc. First Florida Wealth Group and First Florida Bank are not registered broker/dealers and are independent of Raymond James Financial Services.

Views expressed are the current opinion of the author and are subject to change without notice. Information provided is general in nature and is not a complete statement of all information necessary for making an investment decision and is not a recommendation or a solicitation to buy or sell any security. Past performance is not indicative of future results. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs. Dollar cost averaging involves continuous investment in securities regardless of fluctuation in price levels of such securities. An investor should consider their ability to continue purchasing through fluctuating price levels. Such a plan does not assure a profit and does not protect against loss in declining markets. The payment of dividends is not guaranteed. Companies may reduce or eliminate the payment of dividends at any given time. Investing always involves risks and you may incur a profit or a loss. No investment strategy can guarantee success.

Holding stocks for the long term does not insure a profitable outcome. Diversification and asset allocation do not ensure a profit or protect against a loss. Every type of investment, including mutual funds, involves risk. Risk refers to the possibility that you will lose money (both principal and any earnings) or fail to make money on an investment. Changing market conditions can create fluctuations in the value of a mutual fund investment. In addition, there are fees and expenses associated with investing in mutual funds that do not usually occur when purchasing individual securities directly. An investment in a money market mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although it seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. A fixed annuity is a long-term, tax-deferred insurance contract designed for retirement. It allows you to create a fixed stream of income through a process called annuitization and also provides a fixed rate of return based on the terms of the contract. Fixed annuities have limitations. If you decide to take your money out early, you may face fees called surrender charges. Plus, if you’re not yet 59½, you may also have to pay an additional 10% tax penalty on top of ordinary income taxes. You should also know that a fixed annuity contains guarantees and protections that are subject to the issuing insurance company’s ability to pay for them. Investing in the energy sector involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.